May 19, 2025

Affiliate Disclosure: We may earn a commission if you buy something through the links on this page (at no extra cost).

In 2011, Wise launched to disrupt the money transfer sector. It enables people to send and receive money–internationally and locally–at mid-market exchange rates and low fees. All costs are known upfront and guaranteed for a predefined period. By contrast, many money transfer companies and banks mark up exchange rates and charge high fees. Some even hide their pricing details in their terms and conditions.

Wise customers can hold 50+ currencies and get bank account details for the US, UK, Eurozone, Australia, and New Zealand through a multi-currency account. A debit Mastercard is also available in some regions. Its business account targets freelancers, entrepreneurs, SMBs, and large companies. It’s an excellent account for paying invoices, receiving money, and batching payments. Finally, Wise manages the money transfer operations for several challenger banks, including N26, Monzo, and bunq. That speaks volumes about its services and reputation in the financial community.

Company Profile

- Founded by Taavet Hinrikus and Kristo Käärmann in 2011

- Headquarters: London, United Kingdom

- Ticker: WISE

- 10+ offices worldwide

- 5,000+ employees on LinkedIn

- Millions of customers

- Customers send billions every month

- Available in 50+ countries

- Customer support and the website are available in multiple languages

Wise Affiliate Program

Wise has an affiliate program. Partnerize’s affiliate marketing software hosts it. Here’s a snapshot.

- Cost per action (CPA): Cost per transfer

- Commission rate: £10+

- Commission type: Single payment, nonrecurring

- Cookie duration: 365 days

- Payout threshold: £30

- Payment options: Bank account (get free bank account details for USD, EUR, GBP, and other currencies)

- Affiliate software/network: Partnerize

Get More Views and Subscribers

Program Eligibility

Wise doesn’t have strict eligibility requirements. Instead, its program is open to bloggers, YouTubers, social media marketers, content creators, and website owners. However, Wise doesn’t partner with voucher or discount code websites, affiliate networks, or partners who only acquire traffic through paid advertising.

How to Sign Up or Apply

Follow these steps to sign up for the Wise affiliate program:

- Visit the Wise affiliate program page.

- Check the FAQs to ensure eligibility.

- Click on the apply button.

- Fill out the application form.

- Read and agree to the terms and conditions.

Program Benefits

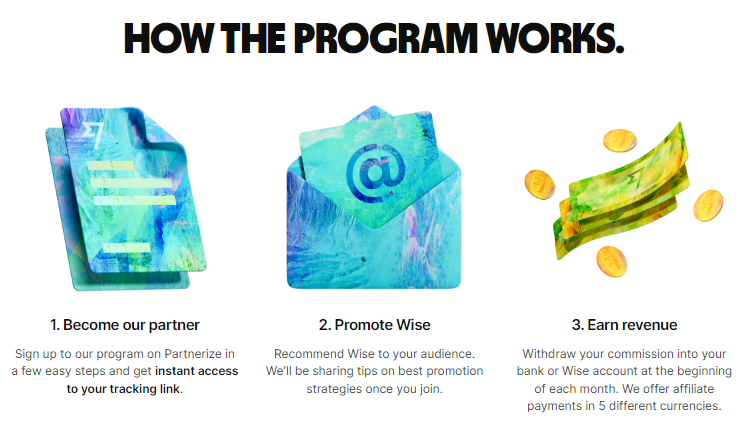

An affiliate signup page outlines the program and how it works, and Wise hits the mark. It outlines everything affiliates should know.

Affiliates can earn fantastic commissions. Wise’s CPA rates start at £10 for personal users and £50 for business customers.

The commission payout threshold is low. Wise issues payments when commissions exceed £30 or the local equivalent. The payouts are sent to the affiliate’s bank account and are offered in five currencies.

Affiliates get a one-year cookie. One of my biggest complaints with some programs is that their cookie/conversion windows are too short. Wise’s referral period exceeds the 30-day industry standard, giving ample time to credit affiliates.

There is a full-time affiliate marketing manager. When a merchant has the staff to support publishers, processes are accelerated, and commitment is demonstrated.

Deep linking is available. It’s how an affiliate creates a link to a specific page on the merchant’s site. Instead of using a standard homepage affiliate link, you can link to a product, page, or article related to your content to increase relevance and conversion rates. Affiliates can deep-link to features, free tools, and blogs.

Affiliates can easily track their results and earnings. Partnerize offers excellent reporting capabilities to monitor your activities, including clicks, impressions, sales, and commissions.

Marketing materials and creative assets are excellent and available in different languages, styles, and sizes. Additionally, Wise affiliates can add calculators and comparison widgets to their sites.

Wise is a pioneer and top-rated financial technology (fintech) company. It was one of the first companies to offer mid-market exchange rates to individuals. Its low fees and transparency serve as industry benchmarks. It has won numerous awards in tech and entrepreneurial circles. Separately, I’ve been using Wise for years and have saved thousands on fees. It’s one of a handful of tools I recommend.

Wise also has a referral program. This program is ideal for existing customers who want to promote Wise to friends, colleagues, and business contacts. However, you cannot combine the referral and affiliate programs to receive higher commissions.

Program Drawbacks

Wise pays attractive commission rates; however, a fixed dollar or variable recurring commission for the customer’s life could be an appealing alternative.

How to Promote Wise

Write blog articles and guides that cater to people who need to send or receive money internationally, such as “How to Save on International Transfers with Wise,” “Using Wise to Pay Overseas Contractors,” or “Comparing Wise to Traditional Banks for Expat Money Transfers.” These topics are valuable to expats, freelancers, or small business owners, and affiliate links can be embedded throughout the content.

Create video tutorials on YouTube that explain how to set up a Wise account, transfer funds, or use a multi-currency account. Screen-share demonstrations of features like setting up rate alerts or calculating fees can educate users on why Wise is an affordable alternative for international transactions. Include your affiliate link in the video description.

Promote Wise’s benefits on social media platforms like Instagram, TikTok, and Facebook. Create posts or stories showing how Wise can help people avoid high fees, access midmarket exchange rates, and make fast transfers.

Share brief case studies, like “How I Saved $50 on a Transfer with Wise” or “Why I Switched to Wise for Overseas Payments,” making the content relatable.

Get involved in finance-related communities on Reddit, Quora, or Facebook Groups, especially in threads for expats, freelancers, or business owners. Answer questions about international payments or money-saving strategies for those living abroad, mentioning Wise as a reliable solution and linking your affiliate content where appropriate.

If you have a finance-focused newsletter, recommend Wise to international payment users, sharing tips or explaining how they can save money. Lead magnets like “Guide to Affordable International Transfers” or “Money-Saving Tips for Expats” can attract sign-ups.

Finally, capitalize on seasonal trends or relevant events, such as tax season, back-to-school for international students, or year-end holidays when people send money to family abroad. Produce timely content around these occasions, highlighting Wise as a reliable, cost-effective choice.

Start Earning

Can you make $1,000 a month as a Wise affiliate? You can and more. Wise supports you with an excellent commission rate and cookie duration. Secondly, it’s carefully expanding its product line to address the needs of freelancers, entrepreneurs, travelers, and business owners like myself. For instance, I frequently use Wise (instead of PayPal) to receive payments and avoid high fees.

Where should Wise rank in your marketing activities? It should be a mid-priority. Wise is a top-rated company and one of the fastest-growing fintechs globally. It maintains an “excellent” rating on Trustpilot, a customer review website. Foreign exchange (forex), money transfer, and remittance also combine for trillions of dollars in transactions annually. Therefore, Wise’s products and services are vital in an increasingly global business and remote working environment.

I recommend joining Wise’s affiliate program because it has excellent potential, and I’ve made money.